corporate tax increase effects

Lower wages for workers results in a decreased. Economic competitiveness and increase the cost of investment in America As a result the researchers found that Bidens proposed corporate tax hike would shrink the overall size of the economy reduce wages and eliminate 159000 jobs.

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Hodge Tax Foundation President.

. This option would increase the corporate income tax rate by 1 percentage point to 22 percent. This higher user cost from the expensing change actually led to a net increase in the effective marginal tax rate EMTR despite the statutory rate reduction undermining the 2 In the Tax Foundations modelling full expensing is permanent. Ensuing debate over how effectively the bill would achieve these ends more jobs better wages global.

Forththe corporate tax is considered the most harmful in terms of collateral economic damage per dollar of revenue raised. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. The elasticity of retail price to the net of corporate tax rates is approximately 017a one percentage point increase in the corporate tax.

The current US. Cutting corporate tax rates leads to increased investment productivity gains and in turn increased economic growth output and higher standards of living. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are levied at such a high rate or percentage that it may hinder the growth of some companies.

That effect on capital investment is not reflected in the revenue estimate. In March the White House announced the American Jobs Plana proposal to spend 2 trillion on infrastructure and other projectspaid for by an increase in the corporate income tax rate from 21. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people.

Click to see full answer. For example a rise in corporation tax on business profits has the same effect as an increase in costs. Effects on the Budget.

Recent decades have seen a downward trend in corporate taxation with headline corporate tax rates falling by 20 percentage points since the early 1980s. Taxation policy affects business costs. Under this the 21 corporate tax rate will increase to 28.

The tax experts warn that this policy change would harm US. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. The Economic Revenue and Distributional Impact of an Increase in the Corporate Income Tax.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. But Republicans are already raising alarms. Using 1970-2007 data from the United States a Tax Foundation study found that for every 1 increase in state and local corporate tax revenues hourly wages can be expected to fall by roughly 250.

The option would increase revenues by 96 billion from 2019 to 2028 the staff of the Joint Committee on Taxation estimates. After the 2007-08 global financial crisis many countries had to. Moreover this plan also looks at trimming down tax preferences for pass-through businesses such as sole.

A recent Goldman Sachs analysis predicted that Bidens plan would reduce 2021 SP 500 earnings by about 12 per share from 170 to 150. CEA The Growth Effects of Corporate Tax Reform and Implications for Wages. Often if a corporation is unable to take advantage of corporate tax loopholes.

The first quartile of countries has an average corporate tax rate of. Combined corporate tax rate of 257 is in the 3rd quartile of tax rates globally. A PricewaterhouseCoopers survey of C-suite executives last.

For example a 2010 study published in the American Economic Journal reviewed a database of corporate income tax rates in 85 countries ultimately finding that effective corporate tax rates have a large and significant adverse effect on corporate investment and entrepreneurship the main drivers of economic growth. The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35 percent to 25 percent would raise GDP by 22 percent increase the private-business capital stock by 62 percent boost wages and hours of work by 19 percent and 03. When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise wages and dominate their competition around the world.

Corporate Income Taxes and Corporate Hiring Decisions. Using the Tax Foundation General Equilibrium Model we can estimate the economic revenue and distributional effects of raising the corporate. A rise in interest rates raises the costs to business of borrowing money and also causes consumers to reduce expenditure leading to a fall in business sales.

A 15 minimum tax will also be imposed to ensure big companies are paying their taxes properly regardless of the number of tax credits and deductions they apply for. The average for advanced economies dipped to 22 in 2015 and investment incentives have further reduced effective rates for transnational corporations.

The Effect Of Tax Cuts Economics Help

Health Insurance Tax Health Insurance Infographic Infographic Health Health Literacy

How Do Taxes Affect Income Inequality Tax Policy Center

The Governor S Tax Plan Is Just The Tip Of The Iceberg Democrat Tax Increases Are Going To Sink Minnesota Business Tax Small Business Tax How To Plan

Reading Tax Changes Macroeconomics

The Effect Of Tax Cuts Economics Help

How Do Taxes Affect Income Inequality Tax Policy Center

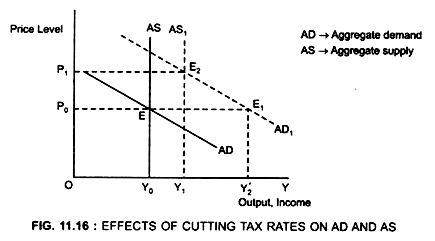

Effects Of Cutting Tax Rates On Ad And As

How Do Taxes Affect Income Inequality Tax Policy Center

29 Crucial Pros Cons Of Taxes E C

Fin 620 Fin620 Quiz 4 Capital Structure And Mm Answers 2020 Umuc Quiz Cost Of Capital Online Study

The Sugar Tax An As Economics Approach Sugar Tax Economics Micro Economics

Corporate Tax Rate Pros And Cons Should It Be Raised

How Do Taxes Affect Income Inequality Tax Policy Center

Logos For Increase Economic Tax Revenue Graphic By Setiawanarief111 Creative Fabrica Icon Design Tax Logo Design

How Do Taxes Affect Income Inequality Tax Policy Center

Deflation Learn Accounting Economics Lessons Accounting And Finance

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)